Visit Our Monitoring Affiliate

Identity Protection - Family Plan

Total Identity Protection for You & Your Family - Delivered by MPPI

Premier Identity

Coverage up to 10 family members

What's Included?

Michigan Property Protection - MPPI - is aProTechs

Detect

You can spot dangers to your data, credit, and identity with the

use of our exclusive monitoring tools.

Resolve

Our experts are on hand around-the-clock to oversee your account recovery and reclaim your identity.

Reimburse

Many of your out-of-pocket expenses, lost wages, or legal bills will

be covered by us.

Coverage for the Whole Family. Powered by

$1 Million

Expense Coverage

Enhanced Financial

Monitoring

Allstate Digital Footprint

Online Account Discovery

Breach Alerts

Data Exposure Insights

Monthly Digital Footprint Service Update

Privacy Insights

Privacy and Permissions Management

Track Where You’ve Been Online

Spot Possible Threats and Data Breaches

How It Works

Family Plan

You and Up to Ten Additional Family Members are Covered

No Age Limit or Floor for Enrolled Family Members

Available to those that have a Social Security Number and Reside in the U.S.

Identity and Financial Monitoring

Social Media Monitoring

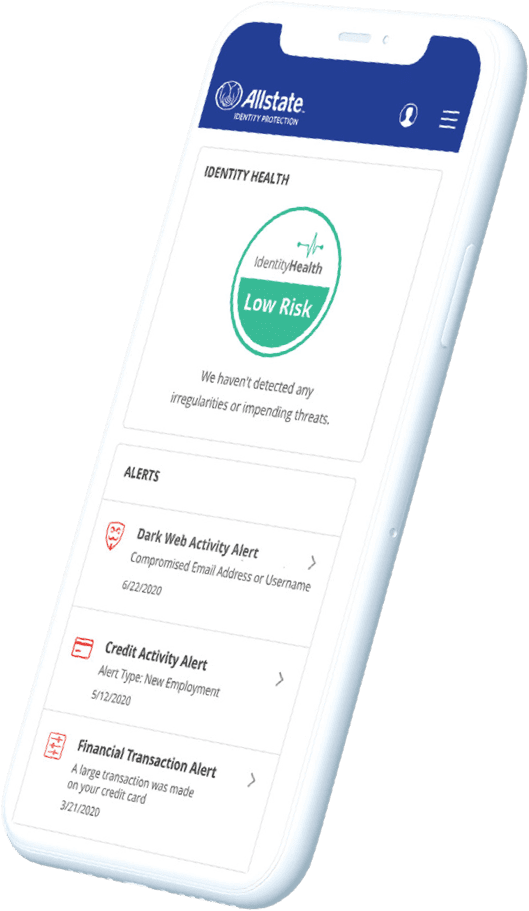

Dark Web Monitoring

24/7 Dedicated Support

$1 Million Expense Coverage

How It Works

Expense Coverage

$1 Million Insurance with $1Million Stolen

Reimbursement for Out-of-Pocket Expenses

Reimbursement for Lost Wages

Reimbursement Legal Bills

Stolen Funds Reimbursement

Lost Wallet Protection

Tax Fraud Refund Advance

Financial Monitoring

Credit Report and Score

Enhanced Financial Monitoring

How It Works

Dark Web Monitoring

Breach Notifications

Human-Sourced Intelligence

Data Breach Notifications

Proprietary Data Detection Platform

Email Scans

Credit/Debit Card Scans

Web Login Scan

Identification Monitoring

Identity Health Status

Solicitation Reduction

How It Works

Social Media Monitoring

Account Takeover Monitoring

Social Monitoring for Vulgarity

Watching for Online Threats

Monitoring and Alerts for Cyberbullying

Email Scans

Web Login Scan

Identification Monitoring

Breach Notifications

How It Works

Identity & Financial Monitoring

Credit Monitoring

Rapid Alert Detection

Credit Freeze Assistance

Credit Fraud Alerts

Unlimited Credit Scores

Monthly Credit Report

High Risk Transaction Monitoring

Student Loan Activity Monitoring

Credit Card Transaction Monitoring

Bank Account Transaction Monitoring

401(k) Investment Accounts

Threshold Monitoring

How It Works

24/7 White Glove Support

In House Certified Privacy Experts

Friendly and Knowledgeable Support Team

US Based Staff

Email Support

Full-Service Remediation

24/7 Support Line

Lost Wallet Assistance

Priority Member Support

Stolen Tax Fraud Advance

How It Works

Safety & Peace of Mind

Powered by Allstate Identity Protection

Why do we let our digital life go unprotected yet having a home security system seems like a no-brainer? With MIProtect ’s total digital coverage and security, you can keep your identity, finances, social media, and more, safe from online predators, scams, and hacks. When you place your trust in MIProtect , you and your family can have complete peace of mind and online safety while using the web.

Visit MPPI To Enroll

Location

23890 Industrial Park Drive

Copyright © 2026 MIProTechs. All Rights Reserved.